Locations

The Zurich Airport Group owns or operates airports at the following locations:

Overview of locations

The percentage stakes held are as follows:

|

Airport |

|

IATA Code |

|

Location |

|

Country |

|

Passengers 2021 |

|

Concession period |

|

Ownership |

|

Zurich |

|

ZRH |

|

Zurich |

|

Switzerland |

|

10.2m |

|

2001 – 2051 |

|

100% |

|

Florianópolis International Airport |

|

FLN |

|

Florianópolis |

|

Brazil |

|

2.4m |

|

2017 – 2047 |

|

100% |

|

Eurico de Aguiar Salles |

|

VIX |

|

Vitória |

|

Brazil |

|

2.0m |

|

2019 – 2049 |

|

100% |

|

Benedito Lacerda Airport |

|

MEA |

|

Macaé |

|

Brazil |

|

0.1m |

|

2019 – 2049 |

|

100% |

|

Belo Horizonte International Airport |

|

CNF |

|

Belo Horizonte |

|

Brazil |

|

6.9m |

|

2014 – 2044 |

|

12.75% |

|

Diego Aracena International Airport |

|

IQQ |

|

Iquique |

|

Chile |

|

1.3m |

|

2018 – 2040 1) |

|

100% |

|

Andrés Sabella Gálvez International Airport |

|

ANF |

|

Antofagasta |

|

Chile |

|

1.5m |

|

2011 – 2025 1) |

|

100% |

|

Curaçao International Airport |

|

CUR |

|

Willemstad |

|

Curaçao |

|

0.8m |

|

2003 – 2033 |

|

9.69% 2) |

|

Noida International Airport |

|

n/a |

|

New-Delhi |

|

India |

|

n/a |

|

2021 – 2061 |

|

100% |

|

Aeropuerto International El Dorado |

|

BOG |

|

Bogotá |

|

Colombia |

|

22.2m |

|

n/a |

|

0% 2) |

1) expected

2) incl. TSA (Technical Service Agreement)

Further information about individual foreign holdings can be found in the International traffic figures section or in note 24.7.

Stakeholder engagement

The Zurich Airport Group has a large number of stakeholders, both in Switzerland and at the airports it operates abroad. Every stakeholder group has its own points of contact with the company, and has different interests and expectations.

Our stakeholders

From the outset the Zurich Airport Group has conducted a dialogue with its most important stakeholder constituencies. In preparation for this report, the list of stakeholders was reviewed and expanded to take in the whole of the Zurich Airport Group. The same internal experts from the divisions who conducted the materiality analysis (see Focus section) were involved in this process. A workshop was held in which all the individual stakeholders were analysed and grouped according to their interests and expectations. The list with the stakeholder groups was then validated and discussed in conjunction an external consultant. As a result, the following ten stakeholder groups were defined:

Stakeholder groups of Zurich Airport Group

Flughafen Zürich AG regularly engages in dialogue with all stakeholder groups. The following sections set out how these groups are defined, the forms of communication used and the respective focal issues.

Residents

Transparent communication with people in neighbouring communities is important to Flughafen Zürich AG. The company publishes information about developments at the airport both online and offline. In relation to noise specifically, the company engages in institutionalised dialogue with public agencies such as the Zurich local residents protection association SBFZ. Flughafen Zürich AG provides information about changes and its development plans, and ensures its actions and intentions are communicated transparently through active participation in information events. The company also liaises with citizens groups in connection with specific projects. Local residents affected by noise can contact a 24/7 noise hotline. See the Noise section for further information.

The company’s Latin American subsidiaries in which it has a majority interest also maintain close contacts with their local communities. All the airports operate a general telephone hotline for residents to report their concerns. They all offer the facility to submit complaints online as well.

Individual customers

The Zurich Airport Group addresses the needs of individual customers, whether passengers or other visitors to its airports. A variety of contact options are available to customers. As well as via contact desks at the airport itself, the company’s Customer Contact Center also receives feedback online or over the telephone. Customer satisfaction is systematically analysed and benchmarked against other comparable European airports. The resulting data are used to identify and implement improvements on an ongoing basis. Zurich Airport regularly scores very highly in passenger satisfaction surveys carried out by third parties (see also Awards).

Airport partners

Along with Flughafen Zürich AG itself, some 270 further partner companies are involved in providing the myriad of services required to run the Zurich Airport complex. Almost all of these airport partners are in a direct contractual relationship, but for the most part they operate independently. Together they ensure the smooth operation of the airport and provision of a full range of amenities. Along with police, border police and rescue services, the airport partners include the airlines and the ground handling, maintenance, cleaning and security firms directly involved in flight operations. They furthermore include retail businesses, hospitality operators and a wide range of service providers for companies and private individuals.

As the licence holder for Zurich Airport, Flughafen Zürich AG attaches great importance to a fair and transparent partnership with all its airport partners. It actively engages in dialogue with these partner companies, wishing to see them prosper to ensure high quality across the board. Evidence of this commitment is the large number of bodies that regularly meet, for example the Airline Operators Committee (AOC) and the Airport User Board (AUB), or the annual meeting of airport tenants. Numerous bilateral meetings are also held.

During the reporting year, the Zurich Airport Group continued to consult extensively with partners at all its airports as regards the impact of the Covid-19 pandemic and the gradual resumption of operations.

Research and education

Flughafen Zürich AG maintains close contacts with universities and organisations engaged in research and education. Senior executives and experts regularly participate in public events and lecture at various universities. In addition, the company has been an active partner in European Union research programmes for many years, for instance the SESAR and AVIATOR programmes. Flughafen Zürich AG regularly makes its personnel and infrastructure available for practice-centered research into new technologies. Additional information can be found in the Regional contribution section.

Capital market

As a listed company, Flughafen Zürich AG is obliged to comply with clear requirements as regards transparency and reporting. In particular, shareholders and external capital providers have a need for information, but also analysts and rating agencies.

Flughafen Zürich AG regularly publishes relevant information about its business situation, such as annual and interim results, monthly traffic statistics and individual ad hoc investor news on its website or by e-mail (see the Corporate Governance, Information policy section for further information). Management and the Investor Relations department maintain dialogue through direct discussions or participation in conferences and roadshows.

Suppliers

At its Zurich headquarters, Flughafen Zürich AG purchases goods and services from around 2500 different suppliers ranging in size from large multinationals down to small local firms. For many of them, Flughafen Zürich AG is a major customer. Suppliers expect mutual fairness and transparency, and are interested in long-term cooperation. Flughafen Zürich AG is in regular contact with many of its suppliers about products and services, including their impact on the environment and society. Additional information about local suppliers and tendering requirements can be found in the Regional contribution section.

The Zurich Airport Group also maintains partnership relationships with suppliers in its international business too. This was particularly evident in the mutual goodwill shown and great efforts undertaken to maintain existing supplier relationships during the most difficult phase of the pandemic.

Media

Airports attract a great deal of interest from the public across a wide range of issues. Here the media plays a dual role of disseminator and intermediary. Open and transparent information is important to the Zurich Airport Group, and the company maintains a collaborative relationship with the media. Its efforts have been recognised: in September 2021, Flughafen Zürich AG’s media office was the recipient of the award for best Swiss media team for the third year running, and for the seventh time altogether.

Employees

The staff representation council (PeV) represents the company's Zurich-based employees both at a collective and individual level. During the reporting year the PeV moved into a separate office and was consequently able to extend its physical presence. Staff have already made use of the resulting opportunities for dialogue. See the Responsible employer section for further information on employees and their right to be consulted.

An open and transparent culture of communication is encouraged within the Zurich Airport Group. At its Zurich base this is conducted via a wide range of channels, ranging from the intranet to the staff newspaper and personal e-mails from the CEO. In addition, regular events are held to enable the Management Board to meet its senior executives and employees in person. The areas on which the company is focusing and key developments during the financial year are communicated when the annual and interim results are announced. Employees are able to put questions directly to the Management Board during these events. The “GL im Gespräch” meet-the-management sessions facilitate institutionalised dialogue with the workforce and enable all interested Zurich-based employees to gain insights into strategic objectives and developments. During the reporting year these discussions took place either online or in a hybrid format. Members of the Management Board are also available for informal and one-on-one conversations throughout the year.

Along with implementation of the constantly changing rules and regulations relating to the Covid-19 pandemic, important topics for the workforce during the reporting year were the economic growth of the sector, future job security and new forms of work.

Non-governmental organisations

The Zurich Airport Group communicates with numerous non-governmental organisations (NGOs). Owing to the wide-ranging nature of issues that arise at Zurich Airport, these include organisations from all spheres of society but in particular ones involved in environmental protection, disability-friendly construction, general aviation, business and commerce as well as labour organisations.

The group also actively engages with NGOs in Latin America on a wide range of issues. These include in particular business and trade interest groups predominantly interested in economic development.

Governments and public authorities

Engaging in dialogue with legislators, administrative authorities and government agencies is very important to the Zurich Airport Group. Airport operation is a highly regulated business in all countries and is subject to both national and international regulations. At the same time, regional (cantonal in Switzerland) and municipal authorities are responsible for certain matters.

In Zurich, a community event with representatives from the administrations of all five neighbouring municipalities is held every year. In addition, meetings on technical matters are held with municipal authorities and agencies as and when required, usually in relation to building projects and to noise arising from aircraft, construction or operations generally. Regular exchanges also take place with representatives of neighbouring districts in Germany.

Regular and ad hoc meetings are likewise held at the cantonal and federal level. These could be with members of the Government Council, the Cantonal Parliament or the competent authorities, in particular with the Office for Mobility of the Canton of Zurich, or at a federal level with the Federal Council, members of parliament and commissions of the Federal Assembly, or in particular with the Federal Office of Civil Aviation (FOCA). Flughafen Zürich AG furthermore takes an active interest in the legislative process, primarily in relation to infrastructure, transport, spatial planning and environmental policy issues.

During the year under review, for instance, Flughafen Zürich AG launched the “Back in the Air” initiative jointly with the severely hit travel and tourism industry. This proposed concrete measures to restore travel freedoms for presentation to the Swiss President.

Regular communication with local governments and authorities also took place at the company's airports abroad with regard to, among other things, further development of the concession models and physical airport development.

Memberships

The Zurich Airport Group is a member of various industrial associations, chambers of commerce and local organisations. Some of the associations and organisations to which the Zurich Airport Group either contributes personnel or funding are: Aerosuisse, economiesuisse, Zurich Chamber of Commerce, Flughafenregion Zürich, the freiwillig@Kloten association, German Airports Association (ADV), and Airports Council International (ACI) Europe/LAC (Latin America and Caribbean)/APAC (Asia Pacific).

Flughafen Zürich AG is also a member of Öbu, the Swiss Business Council for Sustainable Development and, since July 2021, also a member of the UN Global Compact.

Air quality

The Zurich Airport Group works hard to mitigate the negative impacts of air pollution. Globally, it is one of the leading airport operators tackling this issue.

Relevance

A range of air pollutants from one of four different source categories are emitted at airports: aircraft, handling operations, airport infrastructure and landside traffic. Pollutants are primarily produced by the combustion of fossil fuels such as kerosene, natural gas, heating oil, diesel or petrol. In addition, particulate matter is produced by tyre abrasion. In comparison with the other sources, aircraft account for the majority of emissions.

Various air pollutants with different characteristics are emitted, but the following are particularly relevant: nitrogen oxides (NOX), particulate matter (PM), volatile organic compounds (VOC) and carbon monoxide (CO).

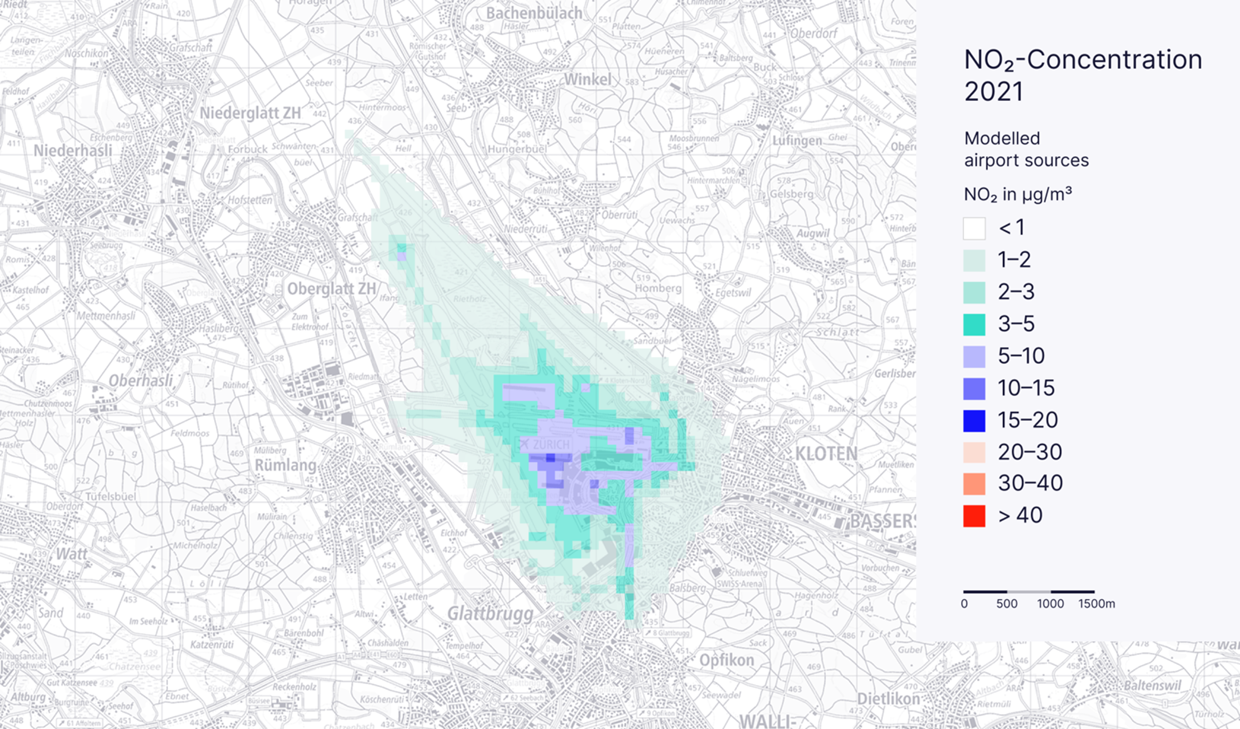

In order to assess air quality at Zurich Airport, pollutants must be monitored from two different perspectives: firstly the quantity emitted at source (‘emissions’), and secondly the quantity measured at a specific location (‘pollution’). A complex interrelationship exists between emissions and pollution exposure: once discharged into the atmosphere, emissions do not remain in the same state – their composition changes, and they are diluted and dispersed before actively becoming pollutants.

Flughafen Zürich AG does everything necessary on the one hand to report on the air pollution situation fully and transparently, and on the other hand to minimise its impact on the environment as far as possible. Today it is known that the air pollution caused directly by airports is only significant within a very narrow radius. In the case of Zurich, residential areas are affected by pollution exposure only to a limited extent.

Approach

Official nitrogen oxide emission limits are specified for Zurich Airport. To document compliance, Flughafen Zürich AG maintains an emissions inventory which records how much of each individual pollutant is emitted annually. The company must also comply with emission standards specified for individual emission sources such as vehicles or heating furnaces.

Concentration standards likewise apply to pollution exposure; this is measured at certain locations and is also modelled over the area as a whole. A network of monitoring equipment has been set up across the airport and the surrounding region. Both fully automatic monitoring stations at Zurich Airport itself as well as passive samplers that measure the amount of the indicator pollutant nitrogen dioxide in the environment are used. Flughafen Zürich AG commenced operating the fully automatic monitoring stations itself from the beginning of the reporting year. The company is taking steps aimed at reducing air pollutant emissions in all four source categories, and not only the ones it produces itself, but also those produced by its airport partners.

Flughafen Zürich AG has long levied emissions-based landing charges to encourage airlines to use low-emission aircraft. Fixed ground power systems to supply electrical power and air conditioning to aircraft are mandated at all gate parking stands. This results in far lower noise, CO2 and pollutant emissions than if aircraft were to use their own auxiliary power units. Operational processes have also been optimised to minimise the amount of time aircraft spend queueing with their engines running. In ground handling, the transition from combustion engines to electric-powered vehicles and equipment is already well underway. Where infrastructure is concerned, new and renovated buildings plus operating optimisation are helping to reduce the demand for fossil-based heating and consequently lower pollutant emissions. Zurich Airport is also taking a number of steps to encourage people to use public transport for travelling to and from the airport, hence reducing private car transport.

During the year under review, emissions of almost all air pollutants at Zurich Airport rose slightly over the previous year. Compared with the period prior to the Covid-19 pandemic, the figures are still down by approximately half. The concentration figures continued to be significantly lower than the long-term average, and no limits were exceeded.

Impact of Zurich Airport on local air quality

No information regarding the air pollution situation is available for the airports in Latin America. Likewise, as yet there are no measurements for Noida in India, although preparatory construction work commenced before the end of the year.

Key data

|

Air quality Zurich Airport (Zurich site), GRI 305 – 7, A05 |

|

Unit |

|

2019 |

|

2020 |

|

2021 |

|

NO x emissions |

|

Tonnes |

|

1,396 |

|

535 |

|

611 |

|

Proportion from aircraft 1) |

|

Tonnes |

|

1,293 2) |

|

469 |

|

539 |

|

Proportion from handling |

|

Tonnes |

|

42 |

|

19 |

|

22 |

|

Proportion from infrastructure |

|

Tonnes |

|

41 |

|

38 |

|

39 |

|

Proportion from landside traffic |

|

Tonnes |

|

20 |

|

9 |

|

11 |

|

VOC emissions |

|

Tonnes |

|

274 |

|

134 |

|

129 |

|

Proportion from aircraft |

|

Tonnes |

|

190 2) |

|

79 |

|

88 |

|

Proportion from handling |

|

Tonnes |

|

19 |

|

8 |

|

9 |

|

Proportion from infrastructure |

|

Tonnes |

|

55 |

|

42 |

|

27 |

|

Proportion from landside traffic |

|

Tonnes |

|

9 |

|

5 |

|

5 |

|

CO emissions |

|

Tonnes |

|

1,297 |

|

544 |

|

568 |

|

Proportion from aircraft |

|

Tonnes |

|

1,209 2) |

|

491 |

|

512 |

|

Proportion from handling |

|

Tonnes |

|

22 |

|

10 |

|

12 |

|

Proportion from infrastructure |

|

Tonnes |

|

17 |

|

14 |

|

15 |

|

Proportion from landside traffic |

|

Tonnes |

|

48 |

|

28 |

|

29 |

|

PM emissions |

|

Tonnes |

|

19 |

|

8 |

|

10 |

|

Proportion from aircraft |

|

Tonnes |

|

15 2) |

|

6 |

|

7 |

|

Proportion from handling |

|

Tonnes |

|

2 |

|

1 |

|

1 |

|

Proportion from infrastructure |

|

Tonnes |

|

2 |

|

1 |

|

2 |

|

Proportion from landside traffic |

|

Tonnes |

|

0 |

|

0 |

|

0 |

1) Flight operations in LTO cycle (up to 915 m), taking into account actual engine power, APU, engine start-up and airframe.

2) Retroactive adjustment to the calculation method.

Key Figures of Zurich Airport Group

3. Loans, advances, non-market-based remuneration

No loans or advances were granted to members of the Board of Directors or the Management Board in 20201 or 2020, nor was non-market-based remuneration paid to parties related to members of the Board of Directors or the Management Board during these years.

2. Remuneration of the Management Board

a) for the reporting period (2021):

|

(CHF) |

|

Salary |

|

Variable remuneration (cash) 1) |

|

Variable remuneration (shares) 1) |

|

Pension and social insurance contributions |

|

Miscellaneous |

|

Total CHF |

|

Number of shares 2) |

|

Share price (CHF) 2) |

|

Recipient |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephan Widrig (CEO) |

|

400,000 |

|

266,751 |

|

133,249 |

|

226,371 |

|

26,994 |

|

1,053,365 |

|

812 |

|

164.10 |

|

Other members of the Management Board 3) |

|

1,364,170 |

|

455,463 |

|

226,622 |

|

568,410 |

|

91,614 |

|

2,706,279 |

|

1,381 |

|

164.10 |

|

Total |

|

1,764,170 |

|

722,214 |

|

359,871 |

|

794,781 |

|

118,608 |

|

3,759,644 |

|

2,193 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount approved by the Annual General Meeting |

|

4,500,000 |

|

|

|

|

||||||||||

1) The allocation is rounded down to a whole number of shares and any remainder is added to the cash component. This may result in a slight change in the apportionment of the variable remuneration between cash and equity components, but the total amount remains unchanged.

2) The number of shares stated above is based on the share price at year-end. The definitive number of shares is calculated on the basis of the share price at the payment date.

3) A new member joined the Management Board on 1 August 2021.

Remuneration of members of the Management Board was effected as shown in the above table. The variable component is based on the degree to which the target for the company’s success set by the Board of Directors for the respective financial year was achieved. In the reporting period the level of target achievement was above the target of 100%. In view of the consolidated loss, the variable remuneration for members of the Management Board was reduced to the target of 100%. In the previous year, the Board of Directors had used its discretion in setting the variable remuneration.

The variable remuneration (cash and share components) is accrued for the period under review and paid out in the spring of the following year. The aggregate variable remuneration (cash and share components) amounts to between 50% and 100% of the fixed salary for individual members of the Management Board. Shares awarded as a component of variable remuneration are blocked for a period of four years (see also “Financial report”, “Consolidated financial statements according to IFRS”, “Notes to the consolidated financial statements”,note 3, Personnel expenses). No long-term remuneration or severance payments were made in 2021.

b) for the prior year (2020):

|

(CHF) |

|

Salary |

|

Variable remuneration (cash) 1) |

|

Variable remuneration (shares) 1) |

|

Pension and social insurance contributions |

|

Miscellaneous |

|

Total CHF |

|

Number of shares |

|

Share price (CHF) 2) |

|

Recipient |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephan Widrig (CEO) |

|

400,000 |

|

186,676 |

|

93,324 |

|

226,332 |

|

26,994 |

|

933,326 |

|

599 |

|

155.80 |

|

Other members of the Management Board |

|

1,260,000 |

|

294,548 |

|

146,452 |

|

518,768 |

|

82,964 |

|

2,302,732 |

|

940 |

|

155.80 |

|

Total |

|

1,660,000 |

|

481,224 |

|

239,776 |

|

745,100 |

|

109,958 |

|

3,236,058 |

|

1,539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount approved by the Annual General Meeting |

|

4,500,000 |

|

|

|

|

||||||||||

1) The allocation is rounded down to a whole number of shares and any remainder is added to the cash component. This may result in a slight change in the apportionment of the variable remuneration between cash and equity components, but the total amount remains unchanged.

2) The number of shares stated above is based on the share price at year-end. The definitive number of shares is calculated on the basis of the share price at the payment date.

Board of Directors

Election and term of office

Members of the Board of Directors are elected by the General Meeting of Shareholders for a term of office of one year. They may stand for re-election, although members of the Board of Directors are required to step down for age reasons at the General Meeting of Shareholders that is held in the year in which they turn 70.

According to the Articles of Incorporation, the Canton of Zurich is entitled to appoint three of seven or eight, or four of nine members of the Board of Directors in accordance with Article 762 of the Swiss Code of Obligations. In the reporting period, the five members to be elected by the General Meeting of Shareholders were elected by individual vote.

Members

Andreas Schmid

- Chairman of the Board of Directors since the 2000 General Meeting of Shareholders

- Swiss citizen, born in 1957, MA (Law); member of the Movenpick Executive Board of Management from 1993 to 1997 and then CEO of Jacobs AG (until 2000); CEO of Barry Callebaut AG (until mid-2002), Chairman of the Board of Directors of Barry Callebaut AG from 1999 to 2005, member of the Board of Directors of Barry Callebaut AG from December 2014 to December 2017 and Vice-Chairman from December 2005; Chairman of the Board of Oettinger Davidoff Group between 2007 and 2017, and Chairman of the Board of Directors of Helvetica Capital AG since 2016

- Other activities and vested interests: Chairman of the Supervisory Board of Villeory & Boch AG, Germany, Member of the Board of Directors of Gategroup Holding AG and of Steiner AG

Vincent Albers

- Member of the Board of Directors since May 2015 (delegation)

- Swiss citizen, born in 1956, degree in mechanical engineering from the Federal Institute of Technology (ETH Zurich) and MSc in management from Stanford Graduate School of Business; mechanical engineer at Amdahl Corp., Sunnyvale and Fujitsu Ltd., Tokyo; Director of Albers & Co AG, Zurich since 1986, responsible since 1992 for the Real Estate division, Partner since 1993

- Other activities and vested interests: CEO of Hardturm AG, member of the Board of Directors of Schoeller Textil AG

Guglielmo Brentel

- Member of the Board of Directors since the 2014 General Meeting of Shareholders

- Swiss citizen, born in 1955, commercial apprenticeship, Swiss federal diploma as administration officer, Swiss Hospitality Management School in Lausanne with Swiss federal diploma; various consultancy roles for the hotel and tourism sector since 1989; founder, owner and managing director of H&G Hotel Gast AG

- Other activities and vested interests: none

Josef Felder

- Member of the Board of Directors since the 2017 General Meeting of Shareholders

- Swiss citizen, born in 1961, Swiss Certified Expert for Accounting and Controlling and Executive MBA Harvard Business School; various positions at Crossair AG between 1989 and 1998, culminating in deputy director and divisional head, then as CEO of Flughafen-Immobilien-Gesellschaft FIG (from 1998 to 2000) and Flughafen Zürich AG (from 2000 to 2008); member of the Boards of Directors at various companies since 2009

- Other activities and vested interests: Vice Chairman of the Board of Directors of Luzerner Kantonalbank AG as well as of AMAG Group AG and subsidiaries, member of the Boards of Directors of Careal Property Group AG, Gebr. Knie Schweizer National-Circus AG and of HTC Corporation, Chairman of the Board of Directors of Musikpunkt Hug Holding AG and member of the Board of Directors of SGV Holding AG

Stephan Gemkow

- Member of the Board of Directors since the 2017 General Meeting of Shareholders

- German citizen, born in 1960, graduated in business management from the University of Paderborn and St. Olaf College, Northfield, MN, USA, business consultant at BDO Deutsche Warentreuhand AG (from 1988 to 1990) and, from 1990, various management roles at Deutsche Lufthansa AG, between 2006 and 2012 Chief Financial Officer and member of the Executive Board; Chairman of the Board of Franz Haniel & Cie. GmbH from 2012 to 2019

- Other activities and vested interests: Member of the Board of Directors of Airbus SE, Leiden, Netherlands, and of Amadeus IT Group S.A., Madrid, Spain, Senior Advisor BNP Paribas Group, Frankfurt, Germany and member of the Board of Trustees of C. D. Waelzholz GmbH & Co. KG, Hagen, Germany

Corine Mauch

- Member of the Board of Directors since the 2011 General Meeting of Shareholders

- Swiss citizen, born in 1960, degree in agr. engineering from the Federal Institute of Technology (ETH); research work (from 1993 to 2002) and political studies (from 2002 to 2008) in the fields of environment, transport, energy and sustainable development; politically active as a member of the City Parliament of Zurich (from 1999 to 2009), Mayor of Zurich since 2009

- Other activities and vested interests: Member of the Greater Zurich Area Foundation Board, member of the Metropolitan Council of the Metropolitan Conference Association of Zurich, Deputy President of the SSV Association of Swiss Cities, member of the Steering Committee of the Association of Mayors of the Canton of Zurich, member of the Technopark Zurich Foundation Board, member of the Foundation Board of Switzerland Innovation Park Zurich, member and patron of Digital Switzerland, member of the Board of Directors of Tonhalle-Gesellschaft Zürich AG

Eveline Saupper

- Member of the Board of Directors since May 2015 (delegation)

- Swiss citizen, born in 1958, PhD (Law); attorney-at-law and federally qualified tax expert; degree from the University of St. Gallen; positions in tax and company law at Homburger AG since 1985, from 1994 to 2014 as Partner and from 2014 to 2017 as “of counsel”; own practice since 2017

- Other activities and vested interests: Member of the Boards of Directors of Clariant AG, Georg Fischer AG, Staubli Holding AG and Tourismus Savognin Bivio Albula AG

Carmen Walker Späh

- Member of the Board of Directors since July 2015 (delegation)

- Swiss citizen, born in 1958, MA (Law); attorney-at-law, head of Legal Services and deputy head of the Building Inspectorate of the City of Winterthur (from 1998 to 2000); independent attorney (from 2000 to 2015), politically active as a member of the Cantonal Parliament (from 2002 to 2015) and since 2015 as member of the Government Council and Head of the Department for Economic Affairs of the Canton of Zurich

- Other activities and vested interests: President of the Greater Zurich Area Foundation Board, location marketing, Vice-Chairwoman of the Board of the Swiss Conference of Cantonal Directors of Finance and of the Conference of Cantonal Directors of Public Transport (KoV), President of the Conference of Directors of Public Transport for the Zurich Region, Chairwoman of the ZVV Transport Council, member of the Swiss Conference of Directors of Building, Planning and Environmental Protection, member of the Conference of Directors of Public Works, Planning and Environmental Protection Region East, President of the Zurich Metropolitan Council and President of the Metropolitan Conference, member of the Intercantonal Conference of the Zurich Metropolitan Area, President of the Gotthard-Komitee, member of the Board of the Swiss Blockchain Federation

None of the members of the Board of Directors holds an executive position at Flughafen Zürich AG, and none was a member of the Management Board of Flughafen Zürich AG or any of its group companies during the three financial years prior to the period under review. As at the reporting date, with the exception of the transactions disclosed in the consolidated financial statements (see note 24.4 Related parties), there were no significant business relationships between members of the Board of Directors or the entities they represent and Flughafen Zürich AG.

According to Article 19 of the company’s Articles of Incorporation, the number of additional mandates that members of the Board of Directors are permitted to hold in the most senior managerial or administrative organs of legal entities outside the scope of consolidation of the company is restricted to five mandates at listed companies and ten mandates at unlisted companies, and to an additional ten mandates at other legal entities entered in the Commercial Register.

Internal organisation

Chairman of the Board of Directors

Andreas Schmid (elected by the General Meeting of Shareholders for one year at a time)

Vice Chairwoman of the Board Of Directors

Eveline Saupper

The Board of Directors has formed the following committees:

Audit & Finance Committee

Members

Josef Felder (Chairman), Stephan Gemkow, Vincent Albers, Andreas Schmid

Duties

This committee is responsible for the close supervision of the annual accounts and the monitoring of compliance with accounting policies, the evaluation of financial reporting and auditing activities, the assessment of findings obtained from audits and recommendations by the auditors and Internal Audit, ICT security and cyber resilience, the definition of the group’s financing policy and an examination of business transactions of special importance.

International Business Committee

Members

Stephan Gemkow (Chairman), Vincent Albers, Andreas Schmid

Duties

This committee reviews the strategic development of existing and new business activities abroad and oversees the development of major investment projects. The committee also considers investment opportunities and proposals for international business, and in particular evaluates and finalises any related tenders to be submitted within the bounds stipulated by the Board of Directors in each case.

Nomination & Compensation Committee

Members

Eveline Saupper (Chairwoman), Vincent Albers, Guglielmo Brentel, Andreas Schmid (are elected by the General Meeting of Shareholders for one year at a time)

Duties

This committee deals with all matters relating to the appointment or removal of members of the executive management of the Group, including their compensation and questions relating to succession planning. It formulates the principles of the Group’s personnel and compensation policies and ensures that these are duly complied with. It is also responsible for assessing any potential conflicts of interest on the part of members of the Board of Directors or Management Board.

Public Affairs Committee

Members

Carmen Walker Späh (Chairwoman), Eveline Saupper, Corine Mauch, Andreas Schmid

Duties

This committee chiefly monitors political matters that are relevant to Zurich Airport and acts as an advisory panel for political issues of strategic importance to the company.

Organisation and participants

The executive bodies of Flughafen Zürich AG convene meetings as required. During the reporting period the Board of Directors held eight meetings (including a two-day conference) with an average duration of around five hours, the Audit & Finance Committee held nine meetings, the International Business Committee held a two-day conference plus two meetings lasting an average of two hours in each case, while the Nomination & Compensation Committee and the Public Affairs Committee each held three meetings with an average duration of two hours.

The committees approve recommendations and submit proposals to the Board of Directors, and arrange for any necessary clarifications by internal or external offices. However, the committees do not pass any final, substantive resolutions.

The Chief Executive Officer, members of the Management Board and the General Secretary are regularly invited to participate in meetings of the Board of Directors; the CEO, CFO and the General Secretary are invited to attend meetings of the Audit & Finance Committee; the CEO, CFO, MD of Zurich Airport International and the General Secretary are invited to attend meetings of the International Business Committee; the CEO, Head of Human Resources and the General Secretary are invited to attend meetings of the Nomination & Compensation Committee; and the CEO, COO, Head of Public Affairs and the General Secretary are invited to attend meetings of the Public Affairs Committee.

Definition of areas of responsibility

Based on the Articles of Incorporation, the Board of Directors has issued a set of organisational regulations in accordance with the provisions of Article 716b of the Swiss Code of Obligations. Alongside the duties that are non-delegable by law, the Board of Directors has retained further fundamental strategic responsibilities, in particular those associated with the rights and obligations arising from federal civil aviation concessions, specifically deciding on significant licence applications, major budget approval requests, petitions for amendments to operating regulations and changes to fees and charges. In all other matters, it entrusts the Management Board with the general management of the company.

Delegates appointed by the Canton

Members of the Board of Directors appointed by the Canton exercise their mandate with the same rights and obligations as every other member of the Board of Directors. The Canton may issue instructions to its delegates in certain legally defined circumstances: this applies to resolutions by the Board of Directors relating to changes in the location or length of runways and to changes to the operating regulations that have a significant impact on aircraft noise exposure.

Information and control instruments vis-à-vis the Management Board

The Management Board reports to the Board of Directors by means of a monthly Management Information System (MIS). Comprehensive financial and business reports are prepared on a quarterly basis, and a report on substantial business risks and the compliance situation every year. The Board of Directors is also kept informed about anticipated developments by means of rolling long-term planning for various scenarios.

In consultation with the Audit & Finance Committee, the external auditors EY (Ernst & Young AG) reviewed the internal control system as part of the interim audit. In the reporting period, Internal Audit, which was set up by management as an independent entity to help the Board of Directors and the Audit & Finance Committee exercise their duty of supervision, reviewed service agreements with third parties, project audits and aspects of retail business along with time and attendance recording, among other things. Follow-up activities to previous audits also took place. Internal Audit reports directly to the Chairman of the Audit & Finance Committee.

Remuneration, participation and loans

The rules relating to the remuneration of the Board of Directors and the Management Board, which are based on Art. 25 ff. of the Articles of Incorporation, and the remuneration paid in the reporting period are shown in the separate Remuneration Report.

Remuneration report

The following Remuneration Report describes the principles of the remuneration policy at Flughafen Zurich AG as well as the associated decision-making powers and the components of remuneration.

1. Remuneration policy at Flughafen Zürich AG

1. Foundations and principles

At Flughafen Zürich AG, the rules governing remuneration are based on the corporate and capital market law requirements of the Swiss Code of Obligations, the Ordinance against Excessive Compensation in Stock Exchange Listed Companies and SIX regulations as well as the company’s Articles of Incorporation (Art. 25 ff.) and any resolutions and rules issued on the basis of these Articles.

The remuneration philosophy of Flughafen Zurich AG is geared to a corporate strategy oriented toward sustainable success. Market-based, performance-oriented remuneration is intended to create the conditions for recruiting and retaining qualified, committed employees in a competitive labour market. The remuneration system should be simply structured, clear and transparent. The basic structure of the company’s existing remuneration system has been unchanged for a long time; over the years there have merely been adjustments to individual aspects.

2. Components and methods of determination

For the remuneration of members of the Board of Directors

Remuneration of active members of the Board of Directors comprises an annual lump sum plus payments for attending meetings. Annual lump sum payments are made in respect of their work on the Board of Directors and its committees (which it may form as and when required). The number of meetings of the Board of Directors and its committees and the number of committees are determined based on business requirements. The total amount to be proposed to the General Meeting of Shareholders for prospective remuneration is designed to also cover financial years in which the Board of Directors faces exceptional situations. The attendance allowances are calculated on the basis of a member’s participation in meetings of the Board of Directors and its committees. The applicable amounts are defined according to the gross principle; that is to say the total amount of fees to be paid by the company is specified, including all statutory social security and occupational pension fund contributions payable by the company.

The applicable amounts are determined on a discretionary basis by the Board of Directors at the request of the Nomination & Compensation Committee. They remain valid indefinitely, that is to say until they are amended by a new resolution, if necessary. There are no bonus or participation programmes for members of the Board of Directors.

For the remuneration of members of the Management Board

Remuneration of members of the Management Board is based on individual employment contracts and comprises a fixed component (fixed salary and benefits) and a variable performance-related component plus employer contributions to social security and pension funds. Two thirds of the variable component is paid out in cash and one third in the form of shares in the company that are blocked for a period of four years, which ensures that the incentives include an element oriented to long-term perspectives.

The fixed component is determined on a discretionary basis, while the variable component is based on the degree to which the target for the company’s success set by the Board of Directors for the respective financial year was achieved. EBIT according to the budget (excluding the influence of aircraft noise) has been adopted as the target. The target bonus proposed for 100% achievement of the target amounts to 100% of the fixed salary for the CEO and 50% of the fixed salary for the other members of the Management Board. If the target is exceeded, variable remuneration is limited to 150% of the target bonus. In the event that achievement falls below 70% of the target, there is no entitlement to variable remuneration. In accordance with the Articles of Incorporation and the regulatory provisions, the Board of Directors can use its discretion to adjust the variable remuneration in justified exceptional cases, while bearing the upper limit of 150% of the target bonus in mind.

The amounts concerned are set each year by the Board of Directors as proposed by the Nomination & Compensation Committee. Members of the Management Board do not participate or have any say in these decisions of the Board of Directors.

3. Approval by the General Meeting of Shareholders

Each year, the General Meeting of Shareholders holds a binding vote on the aggregate amount of remuneration for the Board of Directors and the Management Board. On the basis of Article 26 of the company’s Articles of Incorporation, this vote is held prospectively; that is, the maximum aggregate amounts that could be paid to the members of the Board of Directors and the Management Board during the following reporting period are submitted to the General Meeting of Shareholders for approval.

In accordance with Article 26 para. 2 of the Articles of Incorporation, an additional sum of 30% of the approved aggregate amount is available as necessary for the remuneration of any subsequently nominated members of the Management Board (per additional member); this sum does not require the approval of the General Meeting of Shareholders.

As the amounts actually to be paid out depend in part on factors not yet known when these amounts are approved (for remuneration of the Board of Directors the actual number of meetings, for remuneration of the Management Board the consolidated result), this prospective method of approval requires that theoretical maximum amounts be used by the General Meeting of Shareholders as a basis for their approval decisions. The remuneration actually paid out for a specific reporting period will be stated the following year in the Remuneration Report, which will be presented to the General Meeting of Shareholders for approval on a consultative basis.

Information policy

Shareholders regularly receive information about current events and developments in the Interim and Annual Reports as well as monthly reports on traffic and trading figures and ad-hoc news releases in “Investor News”. Ad-hoc announcements from the company can be read online at www.flughafen-zuerich.ch/newsroom/investor-news/. Anyone interested in receiving these Investor News can subscribe to Investor News.

For further information, please see Investor Relations.

Blackout periods

During the period prior to the announcement of the company’s interim and annual results, a general blackout applies to members of the Board of Directors and Management Board and to all employees with access to insider information, without exception. They are not permitted to buy or sell Flughafen Zürich AG shares and options during these blackout periods. No information or estimations beyond already published financial market information may be provided to third parties. The duration of the blackout period is specified by the CFO on a case-by-case basis depending on the work required to produce the respective results, and ends on the day of publication. The blackout period is usually approximately 50 days for the annual results and around 35 days for the interim results.